This FAQ page will be updated periodically.

Background Questions

Activity Informed Budgeting is a budget method designed to allocate revenues to the operating units of our university in support of our varied missions. This model will help the University navigate the increasingly complex challenges and opportunities in higher education over the next 10 years. It was also designed to provide greater transparency into the budget process. The intention of AIB is to allow our allocation process to become less formulaic and more strategic.

- Ensure adequate funds centrally to meet institutional strategic opportunities

- Reward positive student outcomes

- Reward positive research outcomes

- Build innovation and interdisciplinary approaches

- Strengthen Leadership/Accountability

- Establish activity-informed budgets for support units and public service/engagement units

- Develop strategic activity-informed allocations to academic units that are consistent within colleges

- Reduce complexity

Click here for more information regarding the Guiding Principles.

AIB provides transparency and predictability around the budgeting process. Allocations rely less on formula and more on strategy. More revenue sources and instructional delivery platforms are now presented in the model and more information on support unit and college budget changes over time are now presented in the model.

The Office of Budget and Planning used an agile and iterative model construction process that included frequent feedback collection and alteration of a Prototype through the use of small increments of development. Feedback was provided through a Working Group of domain experts, an Executive Leadership committee, and a Stakeholder Advisory Committee in conjunction with the university's Strategic Planning and Budget Advisory Commitee (SPBAC).

The revenue sources include: net tuition (undergraduate and graduate), facilities & administrative cost recovery, local sources, and other unrestricted sources (state appropriations, administrative service charge revenues, and investment income). See linked Definitions Guide for explanations of these terms and AIB Visual Aid for more information.

AIB was implemented on July 1, 2022, the start of FY 2023.

Activity Metrics

No. The AIB model does not weight or index SCH.

The underlying cost structures of colleges are complex and vary due to a number of factors, including the instructional cost for delivering SCH, but also costs associated with non-sponsored research, academic support, and public service.

For more background and a detailed explanation for the reasons behind this decision, please see this white paper.

Two assignment methods were considered. Please see the flowchart describing these methods. The method selected was the Course Owner method, which means SCH is assigned based on the primary department who owns the course. Many courses are cross-listed, but there is always one primary department assigned ownership and this department receives credit for SCH in AIB. The college/unit that houses this department then has an activity budget measured by changes in SCH assigned to these departments. If the Academic Organization is an unofficial department, then the Academic Organization is mapped to an associated official Budget Department so budget can be allocated within AIB.

The Course Owner method was selected because it is easier to understand and because there is already close alignment between who owns the course and who teaches the course. If a unit wishes to distribute funds to teach a course, this agreement should be handled separately from the budget distribution and assignment logic. We offer an MOU for your use here.

AIB only counts unique students. If a student has two or more majors or degree programs, then the student's enrollment is split proportionally between the number of programs or degrees. AIB will refer to student counts as enrollments, to distinguish them from majors which a student can possess more than one of.

No. AIB does not have a space charge component.

No. On-Campus, Summer/Winter, Online, Distance, and International Direct are broken out into their own columns in the model and have different UG SCH values. Although Summer/Winter data are broken out, the distribution rates per SCH and Major are aligned with On-Campus rates.

Colleges and support units will continue to be expected to fund their salary increase programs from a combination of activity allocations and strategic budget allocations. There is currently no specific allocation dedicated to salary increase programs within the budget model.

The amount of Graduate Net Tuition Revenue (NTR) generated varies widely by academic program. There are three main reasons for this variability: 1) different programs attract a different mix of residents and non-residents, with some programs being made up almost entirely of one population or the other; 2) different programs require different levels of financial aid to attract students, some with very little aid required and others with more; and 3) the number of credit hours required to complete graduate academic programs varies as well. Since Graduate NTR is therefore not as uniform among programs as it is for Undergraduate programs, the use of a pooling approach would disproportionately impact some colleges in inequitable ways and, as such, AIB is designed to distribute revenues based on the NTR generated by each individual student.

These types of metrics are not included in the Activity Informed allocation for Graduate NTR but could be considered as part of the Key Performance Indicators (KPIs) or Objectives and Key Results (OKRs) measures that would be college-specific and inform their Strategic Budget Allocations.

AIB development had a strategic objective of remaining simple to understand and forecast and it was determined these type of performance metrics would add too much complexity to the distribution and therefore limit planning or forecasting efforts.

For graduate programs, since revenue is calculated on a student-by-student basis, yes. For undergraduate programs, there is a single metric for student credit hours, enrollment, and degrees that will be utilized for all programs.

The AIB Model metric Inflation Rider percent increase figures are determined through consultation with the AIB Steering Committee. The percentage selected is impacted by a variety of factors including planned increases to tuition, forecasted changes in net tuition revenue, and impacts on resources available to be distributed based on metric versus resources made available as Strategic Budget Allocation (SBA) funds.

All institutional aid (policy, merit, need) applied to graduate students by a central administrative unit (Financial Aid Office, Bursar, and/or Graduate College) is applied ratably and evenly to all students as a % of total NTR collected that term for each campus/delivery platform. For example, if $10,000,000 was collected in Main Campus Fall semester and $500,000 of institutional aid was awarded, then 5% would be applied to recover this aid to each individual student before factoring in college aid, remission, or other components of graduate NTR.

RCM Transition to AIB

Yes, the “Historical RCM Allocation” on the Allocations and College & Division tabs of the model indicates what allocations resulted from the RCM Model.

Based on the lessons learned from RCM and feedback received from the campus community, the University decided to transition to AIB to reduce complexity and increase transparency. AIB provides the tools necessary to make the informed financial and strategic decisions that best meet our common goal of upholding the University’s long-term educational, research, and land-grant missions.

College committees have been formed to ensure a distribution model is developed and understood within each college. Additionally, the Provost has communicated these expectations to the deans and to the committee chairs in every college. (See Committees & Working Groups on the AIB website for more information.) When the college plans are finalized, it is expected that the AIB website will link to them.

AIB continues to distribute funds to the colleges and each college has a mechanism for distributing funds to departments, as outlined and communicated by the college AIB committees.

There is no change in this area between the pre-AIB revenue distributions and AIB. Colleges have always been responsible for determining how funds flow from college to department and AIB is no different in this regard.

Since Program Fees and Differential Tuition (PFDT) are not part of AIB as it was in RCM, the Office of Budget and Planning (OBP) will not be creating any reports for PFDT. There are existing reports in Analytics that can be leveraged for this purpose.

Of note, beginning FY25 undergraduate PFDT is being replaced by a new College Fee that will also be managed through a revenue distribution model. OBP will support reporting and distributions for this model.

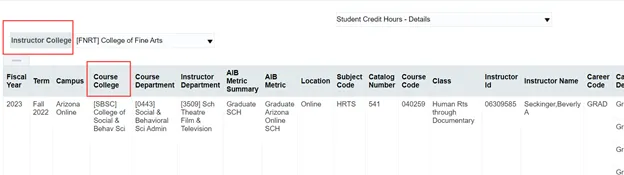

Given the number of dimensions required to maintain the Graduate NTR dataset in Analytics, the instructor is not included in the Graduate NTR dashboard at this time, but it is included in the Student Credit Hours dashboard, yes.

Functional Model & AIB Dashboard Questions.

Yes. The model will always maintain three years of historical data always maintain three years of historical data, current year forecasts, and three years of additional planning estimates for a total of seven years of presented data.

There is always a current year plus three planning years of forecast data, so 4 years total. These estimates will be updated at a minimum of twice a year, once in the fall and once in the spring.

No, it only includes state, locally allocated, and cash F&A disbursements. AIB treats PFDT as a "Local Source" and apply revenue sharing but is not treating PFDT as an "Allocated" fund within the model.

All versions of the model now include a "Base Budget Reconciliation" tab designed to allow each college or support unit to match the model to Base Budget as reported in All Funds or in Analytics reports such as the Income / Expense report.

Models are released after Fall Census and Spring Term End. Current models can be found here.

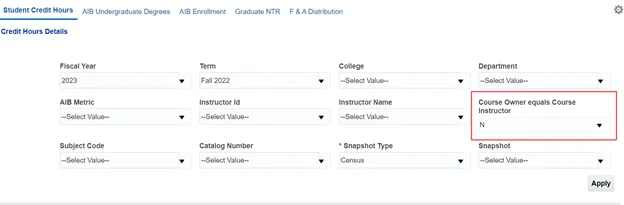

Activity Informed Budgeting Dashboard in UAccess Analytics>Select Metric (Student Credit Hours/AIB Undergraduate Degrees/ AIB Enrollment/ Graduate NTR)> Select “Student Credit Hours”> Select “Student Credit Hour Details”>Select “Term” and/or “Snapshot”

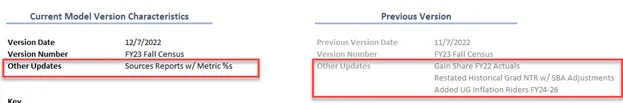

Yes. The Model Info tab provides the items updated in current and previous versions of the model. See example below.

For Graduate NTR, the percentages are on the Model drivers tab. For Undergraduate NTR, the percentages are in all Sources tabs of the Model.

Please consult your college finance office to determine the appropriate process within your college.

Yes, please see filters and approach below that will allow you to compare Instructor College to Course Owner College.

AIB and All Funds are complimentary processes used to determine budgets for all operating units of the university. AIB helps drive planning and allocations for Activity-based budget changes and Gain Sharing and SBA reallocations, as well as communicate decisions made associated with new SBA and Gain Sharing investments. SBA and Gain Sharing investments are determined by Senior Leadership by leveraging the All Funds planning process.

All Unrestricted funds other than Auxiliary are excluded from SBA Revenue Share, so State and Designated.

Two times per year. Once for the Fall Census model re-forecast activity adjustments and to process year-end Gain Sharing entries. (October-November timeframe) A second time for Year-End True-up of current year activity and to load next year budget allocation decisions resulting from All Funds and next year activity estimates. (May-June timeframe)

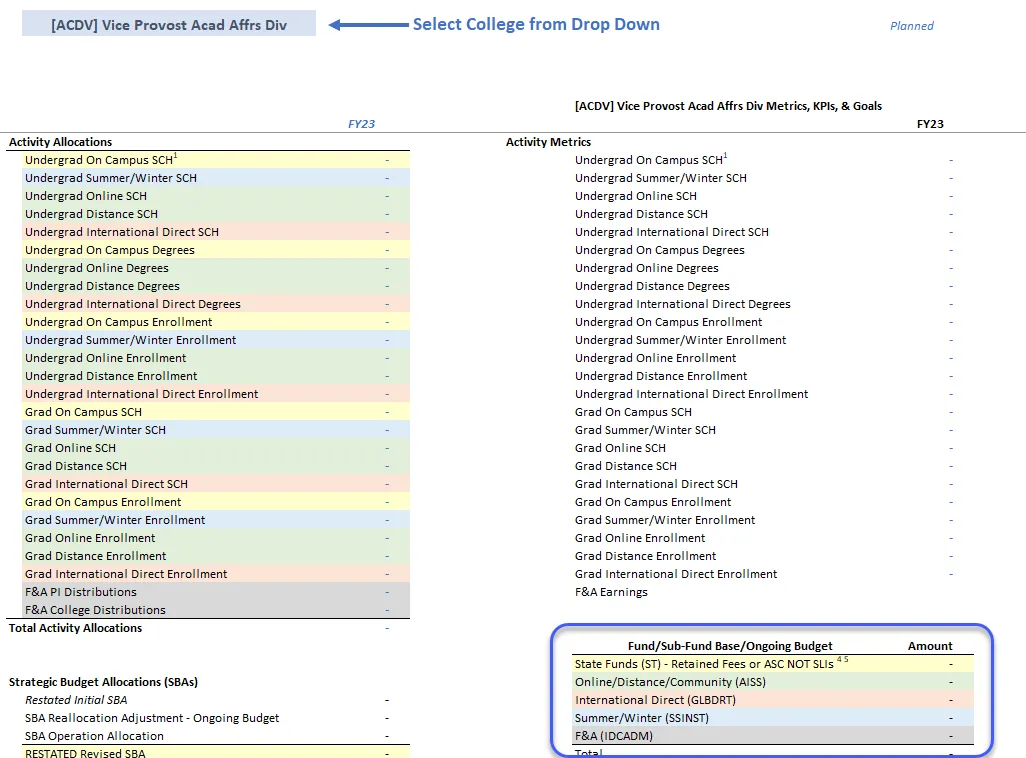

- Yes, on the Sub-Fund Reconciliation Tool tab. The yellow rows will match your STA Planning fund. Green rows will equal sub-fund AISS, or Online and Distance. Blue rows will equal sub-fund SSINST, or Summer/Winter. Orange rows will equal sub-fund GLBDRT, or International Direct. Grey rows will equal sub-fund IDCADM, or F&A.

- Any variance between current base budget and your total SBA plus Activity budgets will be reconciled on the Base Budget Reconciliation tab.

Strategic Budget Allocation (SBA)

Strategic Budget Allocations (SBA) are a major component and allocation tool of AIB. Allocations are made to colleges and support units by senior leadership based on strategy and performance assessment rather than metrics or formulas. Decisions are made as an outcome of the annual All Funds Planning process that runs in parallel with the budget model. Some examples of factors and Key Performance Indicators (KPIs) influencing allocation decisions include:

- Differential Cost of Instruction

- Non-Sponsored Research Costs

- Service Portfolio

- Faculty and Staff Salaries as Compared to Market

- Operational Efficiency

- Existing Financial Resources

- Strategies and Goals of the Unit

- Stakeholder Needs

- Unit-Specific Mission

- Market Opportunities

- Facilities-Related Costs

- Supporting differential cost of instruction across colleges

- Strategic college investments

- Supporting non-sponsored research expenditures

- Unavoidable institutional costs such as utilities and insurance

- Support unit operating budgets

- Salary program support

Gain Sharing is calculated based on year-end actual expenditures for unrestricted funds and can be pulled from the Operating Budget and Trend report in Analytics or Anaplan. Funds and sub-funds excluded from State, Designated, and Auxiliary (unrestricted) funds are listed in the model under the "Excluded Sub Fund List."

More details on the Gain Share calculations can be found on the Model Resources page and in this video.

Units can plan transfers out for Gain Share assessments if they elect to. If you choose to plan these transfers, you will enter them into Organization Code 9953 using Budget Account CC457 One-Time Allocations.

If you transfer Base Budget between units, you are inherently transferring SBA and all associated rules and responsibilities associated with SBA including the 3% annual reallocation among colleges.

These columns help determine whether units are eligible for one-time SBA allocations. "Remaining Unrestricted Balance" calculates a unit’s remaining unrestricted fund balance. This is calculated by summing a unit’s net available unrestricted balance with the unit’s gain share contribution. The "CY>50% of Op Exp?" column then takes the calculated remaining unrestricted and divides it by the unit’s total unrestricted operating expenditures. If this ratio is greater than 50%, then the unit is not eligible for one-time budget allocations. Units who are eligible for one-time budget allocations will see this column with ‘No’. ‘No’ means the unit’s remaining unrestricted balance is less than 50% of their unrestricted operating expenditures and they are therefore eligible to receive one-time SBA allocations.

Graduate Net Tuition Revenue (NTR), College Waivers, and Institutional Financial Aid

Waivers are assigned to students by their SCH and enrollment. The SCH that is assigned to the college outside the student’s college of enrollment will be assigned a portion of the student’s waiver.

No, there is no differentiation in the AIB college waiver logic for different types of graduate programs.

Graduate NTR is distributed 85% to College Activity (17% of NTR to college of enrollment, 68% to college owning SCH) and 15% SBA Grad Activity Revenue Sharing. College waivers are capped at 10% of Net Tuition Revenue before Revenue Share. Revenues from GAs from unrestricted funding sources are excluded from revenue share.

For additional information, also see the graduate NTR quick reference guide that details how to use the AIB Graduate Net Tuition Revenue reports in analytics. Also see the graduate NTR logic slide deck and accompanying Excel reference tools.

Principal Investigator (PI) 2% Facilities & Administrative (F&A) Cost Recovery Allocations

PIs will receive an annual distribution of 2% of Annual Earnings (“F&A Revenue Allocation”), by college, as calculated within the AIB F&A Dashboard associated with “Investigator Name,” so long as the PI is a UArizona employee or employee of an affiliated healthcare partner who also meets the UA eligibility requirements to serve as a Principal Investigator per UA Policy:

Minimum Annual Distributions will be set at $200/year. Earnings by individual PIs below $200 will be distributed to the college / support unit associated with the award F&A. All F&A distributions in AIB go to the college, therefore PI distributions are managed by your college finance teams.

Funds can be used for any purpose allowed under current UArizona purchasing policies.

The Dean / VP of the college / support unit shall determine if additional funding is available for distribution to PIs from the college / support unit F&A Revenue Allocation funds.

Annually, at a minimum – more frequently if deemed feasible within a college or support division.

No.

Deans / VPs are encouraged to set their own policies regarding use and carryforward of these funds. AIB rules will consider these funds as general operating funds and therefore they will be counted as unrestricted funds subject to Gain Share.

Deans / VPs have oversight of policies regarding use and carryforward of F&A funds.

Any reporting method is allowed. A single college / division account with sub-accounts by PI was recommended by a number of finance officers as likely a common and productive reporting model to use within our current financial system and chart of accounts.